With the looming decision on California’s new Net Energy Metering tariff “NEM-3” expected shortly, we’ve been keeping our users up to date on where the proceeding stands and highlighting important aspects that project developers need to be aware of. We recently summarized the expected requirements for qualifying forgrandfathering protections under NEM-2, how significantly solar exports may get discounted in a NEM-3 world, andhow quickly the glidepath transition to NEM-3 will be implemented. This blog focuses on an equally consequential issue: the Grid Benefits Charge (GBC), which is a solar fee being proposed by the investor-owned utilities (IOUs). As currently proposed, these solar fees would be very destructive to solar project economics. We believe GBCs are a big wildcard and will go a long way towards determining how detrimental the NEM-3 decision will be for future solar customers in California.

Fees will be based on Solar System Size

The GBCs being proposed by “The Joint Utilities” – Pacific Gas & Electric (PG&E), San Diego Gas & Electric (SDG&E), and Southern California Edison (SCE) – would be assessed monthly at a fixed amount, based on a customer’s installed solar system size in AC kilowatts. This solar fee would be non-bypassable, meaning under no circumstances would a customer be able to offset or avoid the charge. The GBCs are being proposed by the IOU’s in addition to significantly reducing the value of export energy. The IOU’s have proposed different GBCs for residential and non-residential customers, which we summarize below.

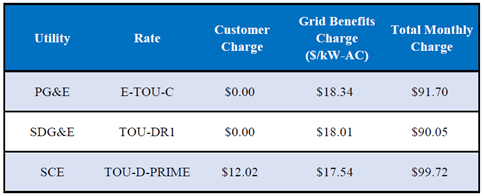

For residential customers, in theIOUs’ Joint Opening Testimony, they proposed specific GBCs if the CPUC did not approve the “cost-based” default rate aspect of their proposal, which sought to default NEM-3 customers to a specific rate, one containing a hefty monthly Customer Charge. Both PG&E and SDG&E initially proposed entirely new rates, E-DER and TOU-DER, while SCE has stated that TOU-D-PRIME would be designated the default rate but mentioned needing to increase the already included Customer Charge. If the California Public Utilities Commission (CPUC) did not approve the default cost-based detail of the IOUs’ proposal, the GBCs would be roughly $4-$7/kW-AC lower.

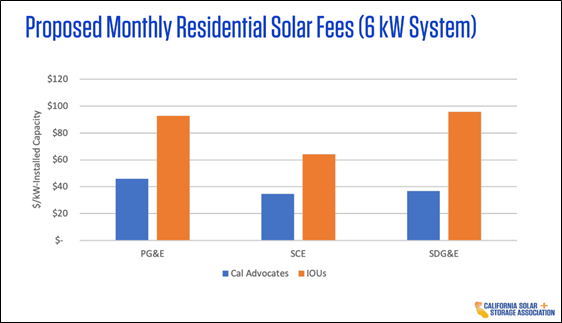

The California Solar and Storage Association (CALSSA) shared a slide in a recent NEM-3 webinar showing what the proposed GBC charges would equate to monthly based on a 6kW PV system from both the IOU’s and Cal Advocates, the independent consumer advocate office of the CPUC.

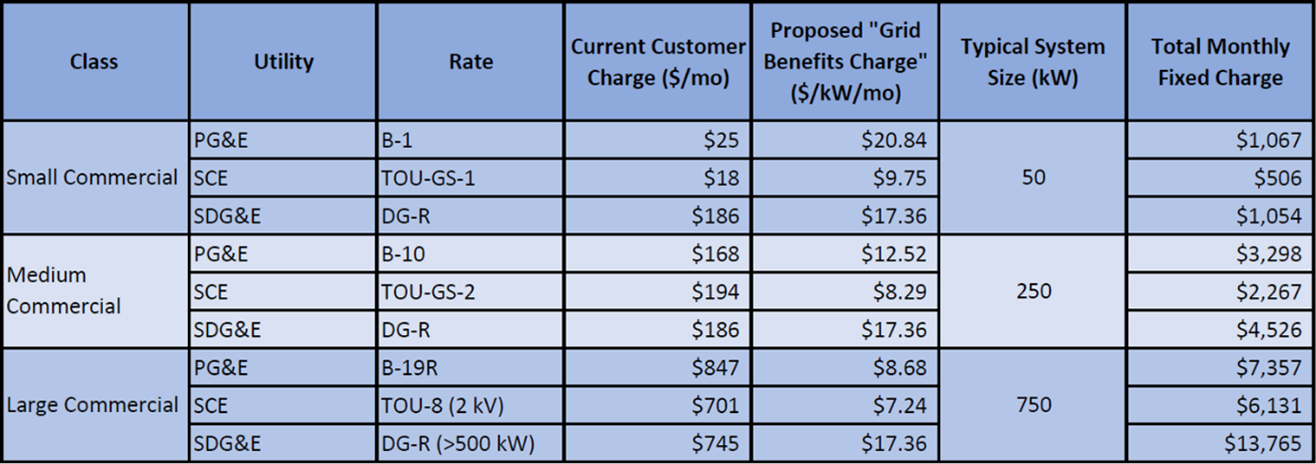

For non-residential customers, the IOU’s proposed GBC’s are equally damning. This summary table below was pulled from a webinar slide the Energy Toolbase team recently hosted with CALSSA:What Will NEM-3 Mean for Commercial solar and energy storage Projects in California.

The Effect on Project Economics

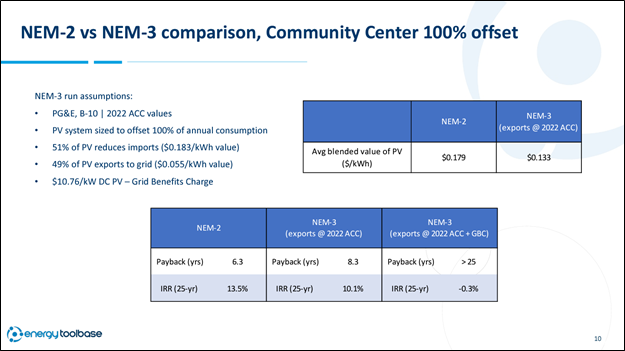

To say that the IOU’s proposed Grid Benefit Charges would hurt solar economics would be an understatement. The case study below illustrates how extreme of an effect levying GBCs would have on a project’s economics. We compared a (i) current NEM-2 scenario, versus a (ii) NEM-3 scenario that only assumes reduced PV exports values and a (iii) NEM-3 scenario that assumes both reduced export values and GBCs. For a 450 kW DC rated PV system for a community center in PG&E territory, the economics would go from a 6.3-year payback with a 13.5% IRR (internal rate of return), to an 8.3-year payback and 10.1% IRR, compared with a 25-year payback and negative IRR for each respective scenario.

The project economic comparisons for a residential customer would be equally extreme when comparing NEM-2 versus NEM-3 with reduced export values and GBC’s. Our belief is that any reasonable modeler would reach the same general conclusion. Therefore, the CPUC will not seriously entertain setting GBC values anywhere close to what the IOU’s have put forward. It would absolutely devastate project economics for customers and the solar market along with it. But it is reasonable to assume that some lower level of solar capacity charges will get approved and levied in the new NEM-3 tariff.

NEM-3 Proposed Decision is Coming Soon

The California solar industry is anxiously awaiting the NEM-3 Proposed Decision, which is expected to drop in the next week or two. The ETB team intends to publish a summary blog on the key rulings when the NEM-3 PD gets released. One of the items we’re especially curious to see is how the CPUC rules on GBC’s, which we think will largely determine how favorable or unfavorable NEM-3 will be for future solar customers. Whatever the outcome, Energy Toolbase users will be able to precisely and intuitively model NEM-3 scenarios on the ETB Developer platform aswe summarized in this recent blog.