California’s “Rule 21” tariff specifies the interconnection, operating, and metering requirements for behind-the-meter (BTM) generation facilities that are connected to a utility’s distribution system. Each California investor-owned utility (IOU) is responsible for the administration ofRule 21 in their service territory and maintains its own version of the rule. Several changes have been made to Rule 21 since the Commission issued an order instituting rulemaking in 2017 to streamline the interconnection of distributed energy resources (DERs). Just recently, in August of 2022, the IOUs have begun adopting Integration Capacity Analysis (ICA) into Rule 21 to inform interconnection siting decisions, streamline the Fast Track process for qualifying projects, and facilitate interconnection process automation.

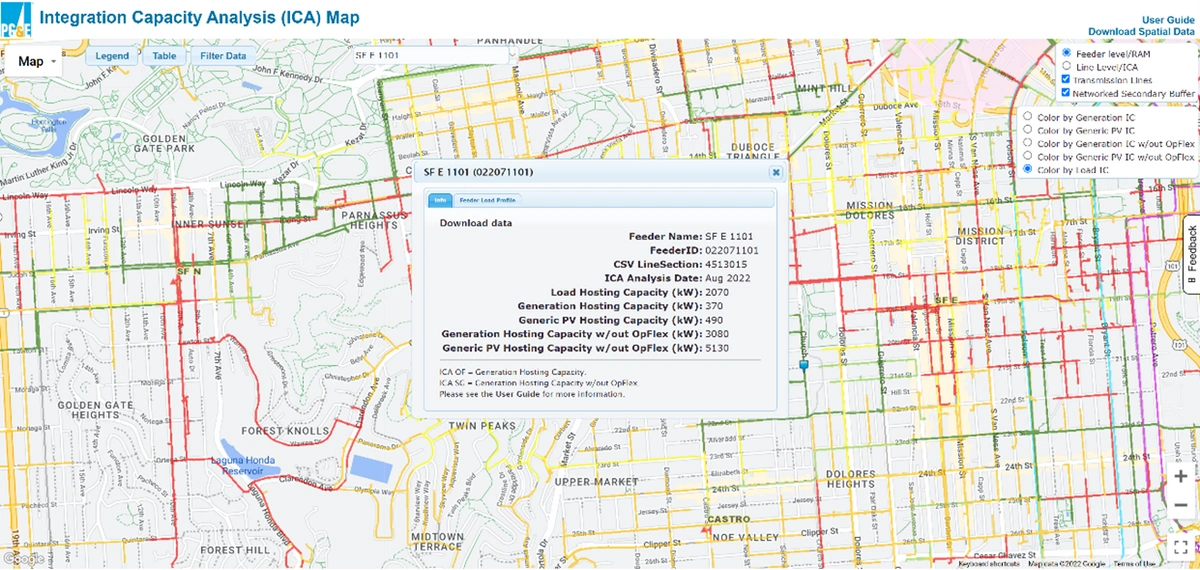

ICA maps can be accessed online, with Pacific Gas & Electric (PG&E), Southern California Edison (SCE), and San Diego Gas & Electric (SDG&E), each having their own portal. Updated monthly, the interactive maps display the DER hosting capacity across thousands of distribution grid circuits. The maps are a valuable tool for developers looking to site new solar and energy storage projects that can be easily and quickly interconnected without constraints, such as grid infrastructure needing to be upgraded. The utilization of sophisticated grid planning resources has become necessary with the continued influx of DER interconnection requests. More than ever before, today’s grid is filled with bidirectional power flow, making advanced distribution planning key.

What’s new?

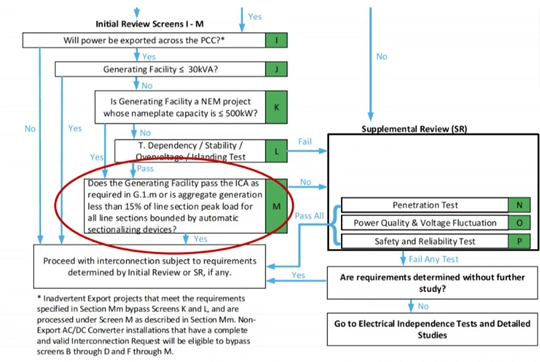

The integration of ICA tools within Rule 21 was developed and recently implemented under the California Public Utilities Commission’s (CPUC) Distribution Resources Plan proceeding. Seasoned developers are familiar with the screens that must be navigated through when submitting an interconnection application.Resolution E-5172 approved the modification of Screen M language to reflect the incorporation of the new ICA-related requirement, where a project must not exceed 90% of the available capacity, as shown in the corresponding ICA map.

Rule 21 Section G.1.m

Screen M: When ICA Values are available at the requested Point of Interconnection, the Distribution Provider shall compare the ICA Values to the Gross Nameplate Rating or typical PV Generation Profile.

For Interconnection Requests based on Gross Nameplate Rating:

a. Is the Generating Facility aggregate Gross Nameplate Rating less than or equal to 90% of the lowest value in the ICA-SG 576 Profile?

or

b. Is the Generating Facility aggregate Gross Nameplate Rating less than or equal to 90% of the lowest value in the ICA-OF 576 Profile?

For Interconnection Requests based on typical PV Generation Profile:

a. Is the Generating Facility Generation Profile based on PVWatts or equivalent less than or equal to 90% of the ICA-SG 576 value in any hour?

or

b. Is the Generating Facility Generation Profile based on PVWatts or equivalent less than or equal to 90% of the ICA-OF 576 value in any hour?

If the response is “yes” to both a) and b), the Interconnection Request passes Screen M. If the response is “no” to either a) or b), the interconnection Request fails Screen M and must be evaluated under the Supplemental Review to determine mitigation requirements.

Integration Capacity Analysis – Static Grid (ICA-SG): The amount of generation (fixed output) that can be installed without any thermal, voltage, or distribution protection violations (not considering operational flexibility) at the time the integration capacity analysis was performed.

Integration Capacity Analysis – with Operational Flexibility (ICA-OF): The amount of generation (fixed output) that can be installed without any thermal, voltage, distribution protection, or operational flexibility violations at the time the integration capacity analysis was performed. Operational Flexibility (OpFlex) limits reverse power flow on certain types of equipment, including reclosers and circuit breakers. When OpFlex is included in the ICA study, reverse flow is prevented, which may result in a lower integration capacity. When OpFlex is not included in the ICA study, reverse flow is allowed, which may result in a higher integration capacity.

To date, SDG&E is the only IOU to implement this change. PG&E interconnection application screens are scheduled to update by the end of September 2022, with SCE expected to implement changes in early 2023. Fast Track evaluation allows for the rapid review of interconnection requests that do not require a Detailed Study. Fast Track review consists of an Initial Review and a Supplemental Review (if needed). Applicants that pass the Initial Review Screens A through M will be allowed to interconnect without Supplemental Review. Note: projects with a nameplate capacity of less than or equal to 30-kilovolt amperes (kVa) do not require ICA evaluation as part of the interconnection process.

Expedited Interconnection Dispute Resolution (EIDR) Process

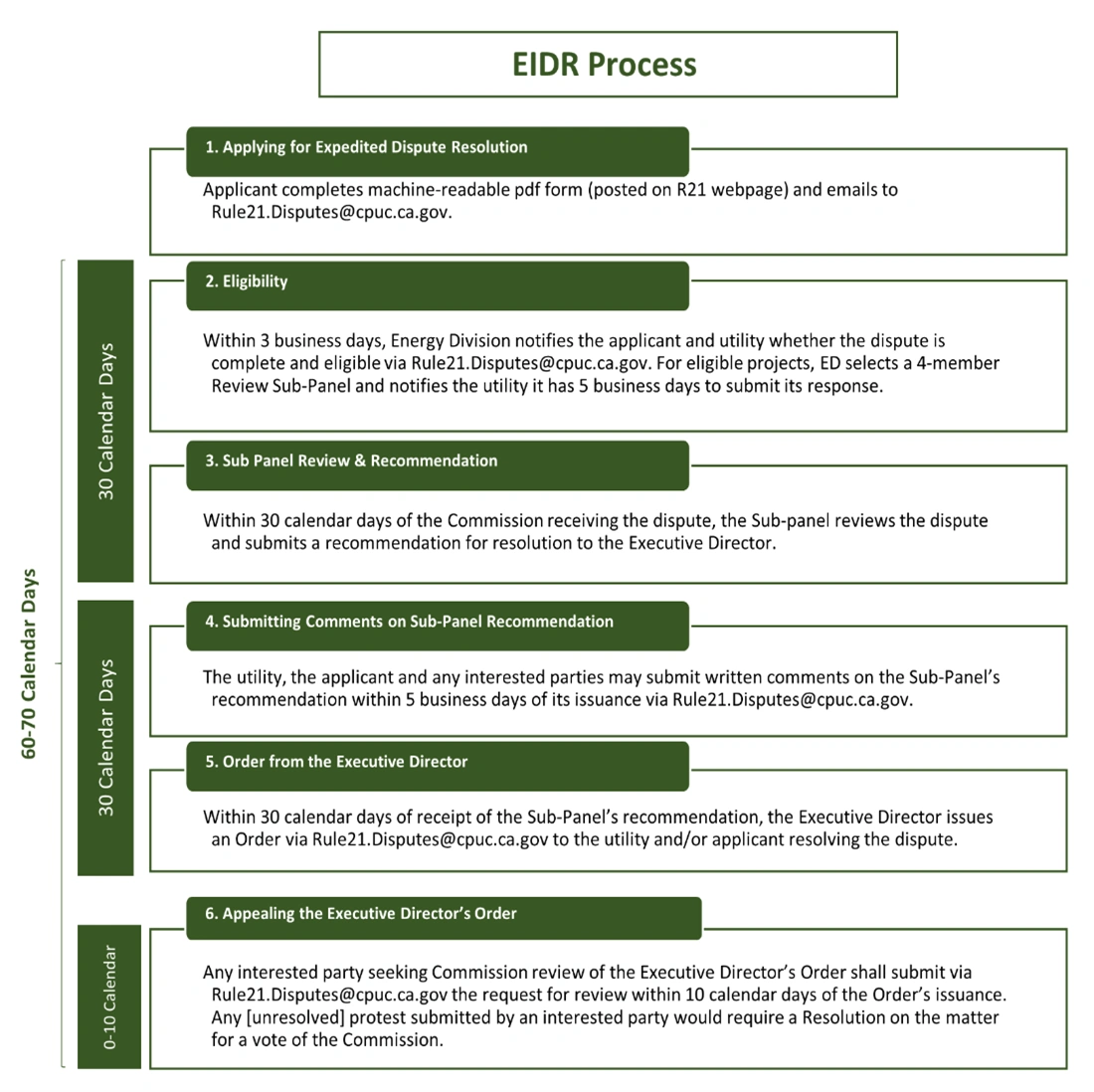

If an interconnection applicant cannot resolve an interconnection-related dispute after working with the utility operating the distribution grid, the applicant may seek to resolve the dispute using the CPUC’s EIDR process. Those looking to submit an EIDR request must first attempt to resolve their dispute directly with the utility through set bilateral negotiations procedures outlined in sections K.2.a(i) of Rule 21. Once an EIDR request has been accepted, a 4-member Review Sub-Panel, comprised of two utility panelists and two non-utility panelists, submits a recommendation to the Executive Director, and a decision on the dispute is issued within 60-70 business days from the EIDR submission.

Additional guidance and resources, including the required Expedited Interconnection Intake Form, can be found on the CPUC’s websitehere.

Other Rule 21 Changes

In addition to incorporating ICA data within the interconnection process, several other updates regarding Rule 21 have recently been implemented. Changes to Rule 21 that developers should be aware of include:

- Under Section G.1.i of Rule 21, “non-export” and “limited export” options have been added. Projects that utilize a certified Power Control System (PCS) with an open loop response time of no more than two seconds are eligible to be processed via Fast Track. Inverter vendors with approved PCS equipment can be foundhere on the California Energy Commission site.

- The installation timeline for projects requiring a Net Generation Output Meter (NGOM) has been set to 40 business days: 20 days for design and 20 days for construction.

- The new standard timeline for interconnection-related distribution upgrades is 120 business days: 60 business days for design and 60 business days for construction.

- IOUs are now required to post quarterly updates regarding substation work.

- PG&E no longer requires projects to install a miniRTU. For DER projects with a total aggregate generation of 1 Megawatt (MW) or larger, PG&E should be issuing conditional PTO with telemetry to be installed at a later date or allowing projects to install customer-owned telemetry (COT) from an approved list of vendors. Information regarding PG&E’s COT Procedure can be foundhere.

- SCE and SDG&E already have the above telemetry procedures in place.

What’s the bottom line?

Reforms and improvements to California’s flagship Rule 21 interconnection tariff are welcomed and appreciated by the solar and storage industry. As interconnections accelerate, increasing grid transparency and utilizing available data to create a more sophisticated way of designing and deploying DER systems is smart policy. ICA pre-determines hosting capacity at every node of the grid, which makes the system more transparent and allows more projects to be fast-tracked. Other Rule 21 changes, such as the EIDR process, PCS for exports, and more prescriptive telemetry requirements creates a more standardized process and give developers more certainty on the timelines.

Now that the Inflation Reduction Act (IRA) has authorized a 10-year extension of both solar and energy storage Investment Tax Credits (ITC), interconnections for DERs will only continue to increase. Ongoing improvements to Rule 21 as the market evolves will be required to enable California to meet its aggressive stated goal of 100% carbon-free electricity by 2045. Hopefully, other state markets, where long interconnection queues are slowing the deployment of more DERs, will follow California’s lead in implementing smart interconnection policy reform.

Learn more about the key policy issues in the California solar + energy storage market and access reports on how they affect the economics of projectshere