Hawaii has set one of the most ambitious statewide renewable energy goals in the country, targeting to reach 100% renewable energy by 2045. This goal is not out of reach by any means, in fact, some islands are predicting that they may even reach that goal before 2045. Hawaii has always been a front runner in the solar market, being the first state to commit to 100% renewable electricity and exceeding milestones many states have yet to reach.

This ambition has encouraged Hawaii’s utilities to get serious about renewable energy as well. Hawaiian Electric Company (HECO) recently sent at least seven new solar plus storage contracts to state regulators that total more than 260 MW of solar and 1 GWh of storage. Six out of seven of those contracts are actually set for the lowest prices that the state has ever seen, at under 10 cents per kilowatt-hour. With the state’s investor-owned utilities making strides like this towards renewable energy, things are heading in the right direction, but Hawaii’s solar + storage market is also extremely policy-driven. The timeline of when programs have opened and closed says a lot about where the market is today.

Arguably the most transformative moves for the market happened when NEM was closed in October of 2015. This was no doubt one of the most popular programs on the island, encouraging energy storage more than ever. Shortly after NEM closed, two additional NEM programs were introduced to take its place; the Custom Grid Supply (CGS) Program and the Customer Self-Supply (CSS) program. CGS still had an export rate, but it was less than the previous retail rate. CSS opened as well, which was designed for solar projects that don’t export any electricity to the grid. But in 2016, CGS had met its cap, and all of this movement in programs led to the rapid decline of PV installations on the islands.

Finally, in July of 2018, the NEM plus opened, in addition to the CGS plus program (similar to CGS but a lower export rate) and the SMART export, which is a time-based tariff that helped permitting and installations get back on track.

Impacts of Policy Changes in Hawaii’s Market

There were sudden and gradual impacts that all of this had on solar in Hawaii. In the height of NEM, project permits were booming and when that program ended, the permits being pulled for PV weakened as a lot of companies were scrambling to figure out what they were going to do next and how they were going to sell their next interconnection program. The decline continued over the next three years, because many of the newer systems needed to include energy storage, and developers hadn’t quite figured out how to sell those to customers.

The market share was significantly impacted. More than 300 active companies in Oahu (which is 70-80% of the residential market) were pulling permits in 2015. As the market declined with the closing of the program, so did the active number of companies pulling new permits. In 2018, there were just 98, down from 300. The shifting of programs clearly had an effect on developers, but also end-users, who no longer have an abundance of contractors and selling companies to choose from. If developers and installers are not given enough headway to these changes, it’s really hard for them to switch their value proposition so quickly.

When CGS opened not only did customers have a lowered credited export amount than the retail rate but the true-up period also changed from a monthly to a yearly true-up period. That threw off a lot of companies’ financial models, on how they could create a value proposition because of the change of the credit rate and the true-up. (Energy Toolbase can obviously help accurately track that, which allows developers and HSEA members that install systems to make credible decisions. We don’t expect small developers to keep track of every tariff and program, that’s why our in-house utility rates team does it for you).

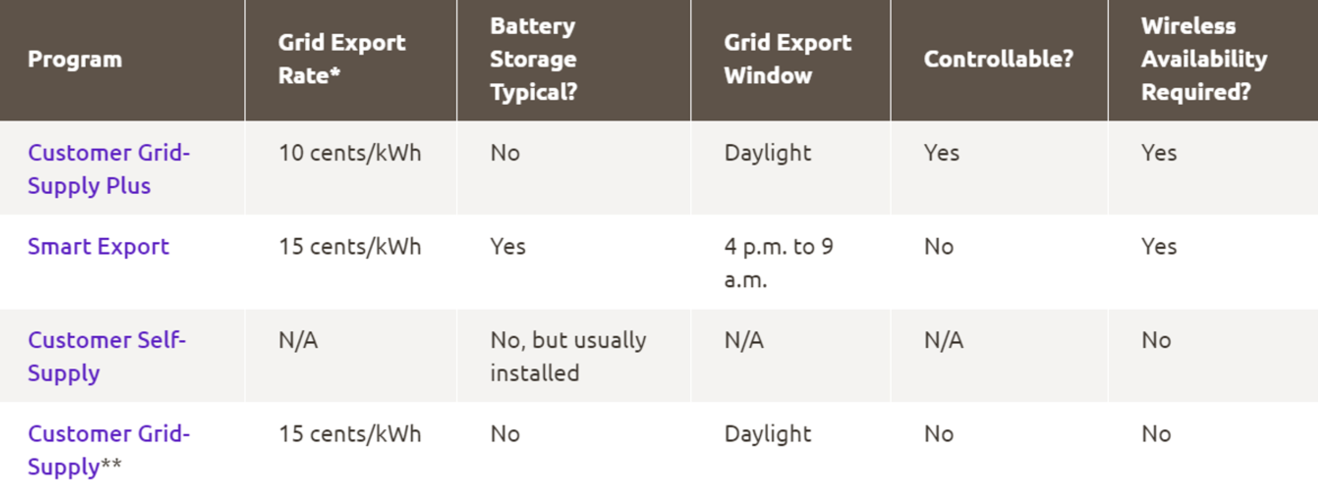

To give you a better insight into what DER programs are currently open to customers, we’ve included a chart below:

DER Market Potential

We all know by now that a PV system provides you with energy, and in most states, you have a NEM type tariff where you can sell energy back to the grid at different rates. HSEA is pushing a concept where you have this credit amount but also can add other credit amounts on top of that as well like on/off functionalities or if the utilities can make use of your storage system.

Community-based renewable energy is another big opportunity that opened on all islands in June of 2018. Community-based solar helps make solar more equitable, providing a tariff program that allows apartment renters or people who can’t have solar the ability to take advantage of the renewable energy systems. Hawaii is also the first state to have performance-based rate-making in the statue. This is a performance mechanism-based rather than a cost-plus rate-making structure.

The end of 2019 will mean big gains for solar as well. The federal ITC is set to phase out, meaning in 2020, it will drop from the full 30 percent tax credit, down to 26 percent. This is hopeful in the sense that many will be scrambling to take advantage of that full 30 percent tax credit before years’ end leading to a generous amount of solar implementation.

The Hawaii Solar Energy Association (HSEA) has played a big role in pushing for policy and legislation that will advance the solar + storage market. The non-profit organization has been helped establish the development of the solar market in Hawaii for the past 35 years and continues to fill that role. HSEA focuses on a lot of different agreements, but one of the biggest ones is regulatory. It intervenes as a stakeholder in a variety of docketed issues, some of the major ones being grid modernization, performance-based regulation, integrated grid planning, and distributed energy resources/demand response. To learn about becoming a member, head to their website.

Future of Hawaii’s Market

Even with all the ups and downs of Hawaii’s market, it’s still the leader in solar + storage deployments. In 2018, both behind-the-meter (BTM) and front-of-the-meter (FTM) energy storage grew at a significant rate and Hawaii was in the top five for states with the most activity overall. New policy changes and legislature will help Hawaii get an even bigger piece of the market in the coming years and storage will continue to play a big role.

Energy Toolbase is one of the only software platforms that can accurately model all of the interconnection programs in Hawaii and show the exact savings energy storage will give to a customer. ETB’s in-house utility rates team also has all of the utilities in rates in Hawaii ready for you to use in your projects. Watch the video below to see a short demo of how we can perfectly model CGS+ and CSS.