In the United States, net metering is under threat across the nation. Numerous states are abandoning traditional net energy metering (NEM) and showing favor of successor tariffs that significantly decrease the value placed on exported energy. NEM structures containing time-varying or avoided cost compensation structures, fixed solar fees, and bill minimums are rapidly becoming the new standard. Many of the policy actions taking place today would result in standalone rooftop solar no longer being a financially feasible option for many businesses and homeowners.

NEM is a billing mechanism that credits solar system owners for solar production exported back to the grid and has been a foundational policy mechanism driving the growth of the rooftop solar PV market nationwide. NEM has been widely utilized and implemented by states since the early 1980s as a customer-sited distributed generation (DG) compensation mechanism. But despite being one of the most predominant policy mechanisms fueling solar adoption, continued growth is being jeopardized as utilities and commissions across the United States move further and further away from traditional net metering.

Full-retail value NEM, which values solar exports at the same rate as utility imports, has been under threat for years as utilities push regulators to implement successor NEM tariffs. The types of NEM successor tariffs and compensation structures being proposed and implemented around the country vary significantly. Some tariffs set export values at a discounted fixed rate; others utilize non-bypassable charges (NBCs) to discount the retail rate. Many of the NEM successor tariffs being implemented today mandate time-varying or avoided cost compensation structures, in addition to imposing fees on solar customers through “grid access” charges or bill minimums. Keeping track of all the NEM changes being proposed and implemented around the country has become dizzying.

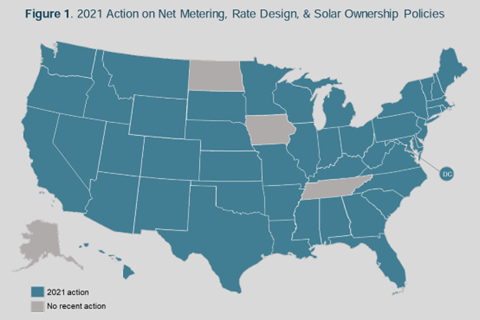

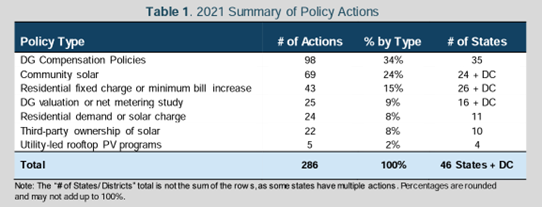

The NC Clean Energy Technology Center (NCCETC) publishes a 50 States of Solar Report to educate state lawmakers, regulators, electric utilities, and the solar industry by providing unbiased updates on policy actions associated with distributed solar PV. The 2021 annual reportexecutive summary states that 46 states took action in 2021 regarding solar NEM policies or rate design changes.

NCCETC’s 2021 annual report showed that policy actions related to the value of solar were the leading type of action. Of the 286 actions taken last year, 98 were specific to DG compensation policies, such as net metering, with 25 related valuations or studies taking place.

An Overview of State NEM Markets

Energy Toolbase’s research indicates that as of early 2022, 29 states have state-mandated net-metering programs that offer full retail value NEM to their customers. However, many of these states are now proposing or already on the path to revising their NEM policies. Despite “go green” initiatives gaining popularity and states declaring bold clean energy goals, the full-retail NEM structure is rapidly becoming a rarity. To illustrate the different types of changes being made, we summarize a handful of state markets that have proposed and/or adopted changes in the last year.

The Carolinas

South Carolina approved successor NEM tariffs for investor-owned utilities (IOUs) Duke Energy and Dominion Energy in 2021, featuring monthly time-of-use (TOU) netting where the value of exports is dependent on the time the energy was exported to the grid. Additionally, minimum bills were implemented, preventing rooftop solar customers from eliminating their utility bills. The utilities claimed bill minimums as a necessary step to cover fixed grid costs and minimize the cost-shift to non-solar customers.

In late 2021, North Carolina Duke Energy proposed a NEM revision very similar to South Carolina’s in which solar customers would be required to be on a TOU rate, with solar exports valued at roughly one-third of the retail rate, around 3¢/kWh. A decision on the state’s successor NEM tariff was delayed through an agreement decided upon by Duke Energy and three of the state’s largest solar companies. If adopted by the NC Utilities Commission, the settlement would implement a “bridge rate” that entails bill minimums, NBCs and monthly netting of exports at the applicable avoided cost rate. This intermediary rate option would be open to new and existing solar customers through 2026, at which point Duke’s original proposal would go into effect.

Florida

The Sunshine State has ranked in the Top 5 states for solar deployments for three consecutive years and now boasts over 8,000 MW of installed PV, when including both front-of-the-meter (FTM) utility-scale and behind-the-meter (BTM) rooftop solar segments. Florida’s rooftop solar industry breathed a sigh of relief when Governor Ron DeSantis vetoed an extremely discriminatory anti-solar net-metering bill (HB 741), passed by the Florida legislators earlier in the year. Solar advocates claimed the bill would have crushed the fledgling rooftop solar market in Florida had it been signed into law, by mandating excess generation to get valued at the utility’s avoided-cost rate of 2-4¢/kWh by 2029, following a pre-determined reduction schedule until then. Furthermore, Florida IOUs would have been granted the ability to petition to impose solar customer-specific fixed charges. This good outcome in Florida was effectively a dodged bullet, which solar advocates hope acts as a precedent for other states considering NEM cuts.

Indiana

Regulators in Indiana are effectively ending NEM altogether via a policy change that solar advocates have said will make solar uneconomic for most all homes and businesses in the state. All five of the state’s IOUs (Duke Energy Indiana, Indiana Michigan Power, NIPSCO, CenterPoint and AES Indiana) are replacing NEM with an excess distributed generation (EDG) policy that credits solar customers at a significantly reduced rate for any unused generated energy, according to the nonprofit group Solar United Neighbors. This fight is now tied up in the courts, where a debate over how exactly EDG credits are calculated is taking place, leaving the statewide industry in limbo.

Connecticut

On a per capita basis, Connecticut has been a leading state for solar deployments nationwide. However, last year the state’s Public Utilities Regulatory Authority (PURA) approved a decision to sunset the state’s NEM policy. As of January 1, 2022, new solar customers can either elect a buy-all/sell-all tariff or a successor NEM program that reduces the value of exports and requires monthly netting.

The buy-all compensation structure is effectively a feed-in tariff and values all PV production at a flat $/kWh rate set by PURA. The customer can elect to have credits offset future bills, receive a quarterly cash payment, or specify a percentage split between the two options. If instead, the customer opts for the monthly netting incentive option, the customer’s electricity needs are first met by solar power, with any leftover energy then sent back to the grid. The net excess generation remaining at the end of the billing cycle will be credited at the customer’s retail rate upon contract agreement, minus a single non-bypassable charge. The credit rates under each incentive option are fixed for 20 years.

The monthly netting incentive is similar to Connecticut’s previous NEM policy, but instead of kWh credits rolling over, monetary credits carry over instead. The Renewable Energy Solutions program is currently set to run through 2027. Solar customers can, however take advantage ofConnecticut’s new energy storage incentive when pairing a battery with their solar PV system, which launched the same day the state’s new NEM policy went into effect.

Kentucky

With less than 8,000 homes powered by solar and only 71 MW of PV installed statewide, Kentucky’s market has yet to shine. But despite the slow growth, last year the state’s Public Service Commission (PSC) approved a reduction in solar export values. Depending on the utility, customers are credited monthly for excess generation, between 7-9.5¢/kWh, which compares to an average blended import rate of 11-12¢/kWh for retail energy in Kentucky, according to recent Energy Information Administration EIA data. In a more positive light, the NEM decision the Kentucky PSC ultimately approved set PV export values at considerably higher rates than what the state’s IOUs initially proposed (2-3¢/kWh).

California

The Golden State has long been the bellwether of the rooftop solar industry, with over 35,000 MW of solar installed, which gives it the top state ranking by a wide margin. All policy eyes have been closely following California’s highly contentious “NEM-3” successor tariff proceeding, which is expected to get a final decision by year-end. The NEM-3 proceeding formally started two years ago, in August of 2020. In December of 2021 the California Public Utilities Commission (CPUC) released a proposed decision (PD) on the matter, which Energy Toolbase summarized in a previous blog:“The key NEM-3 issues to be aware of.”

The PD adopted many components of the IOUs’ initial proposal, which would have dealt a crushing blow to the rooftop solar industry if implemented. Export values were to be based onavoided cost calculator (ACC) rates, which equated to 5-6¢/kWh on average. Additionally, the PD levied grid participation charges (GPCs) on residential customers based on installed solar-kilowatt capacity. Furthermore, the PD called for the grandfathering period of existing NEM-2 solar customers to be reduced.

Fortunately, the PD was soundly rejected, which sent the CPUC back to the drawing board and led to a prolonged delay. Independent industry research firm Wood McKenzie forecasted a 45% decline in the volume of residential solar installations if the CPUC’s December PD was to be adopted. In May, the CPUC issued a ruling requesting additional input on various elements of the PD, which Energy Toolbase summarizedin a recent blog. A revised PD is now expected to come in August, with implementation slated for the end of 2022 at the earliest.

The Takeaway

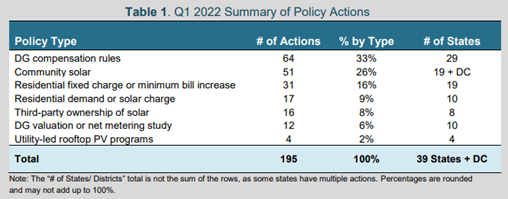

Proposed changes to NEM tariffs and solar policy actions are continuing to accelerate. After 2021’s big year of change, theQ1 of 2022 NCCETC’s 50 States of Solar report counted 195 policy actions taking place across 39 states. NCCETC stated that this represented a record for actions taken in an individual quarter. DG compensation rules remain the top policy type being acted on.

While the proposed changes continue to vary, the one common thread is that they cause erosion to the value of solar. As summarized in the examples above, the bill mechanisms can take different forms, from reducing export rates and implementing fixed charges and bill minimums to disallowing the carry-forward of credits into future months or credits simply being set to zero at the end of a true-up period. Many of the successor NEM tariffs seen today are aggressively eroding the value of solar, causing the economics of standalone PV projects to become less compelling.

The one silver lining of many of these regressive NEM changes is that they create a stronger price signal and opportunity for pairing solar with an energy storage system (ESS). In states that have aggressively cut the value of exported solar energy to the grid, Hawaii being a well-known example, ESS attachment rates have increased dramatically. As NEM frameworks continue to evolve, we fully expect solar paired storage to rapidly become the standard in many of these successor NEM tariff markets.