Renewable Energy Credits (RECs) produced by Solar PV systems in California now have meaningful value in the state’s Low Carbon Fuel Standard (LCFS) program, which allows transportation fuel producers to purchase RECs to offset their carbon intensity. Assuming all necessary steps are met, solar system owners in California can capture additional revenue by selling their RECs. To give a rough idea of value, California LCFS solar RECs are currently valued around $15/REC (as of Q2 2024). A 500 kW DC rated PV system producing ~750 RECs per year would generate ~$11,250 in REC gross revenue annually, before fees. We summarize this math in more detail below.

What are REC's

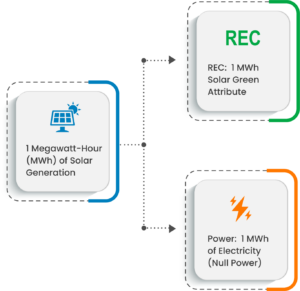

RECs represent the clean energy and environmental attributes produced by a solar PV system. 1 REC = 1 megawatt-hour (or 1,000 kilowatt-hours) of solar PV energy produced. RECs are effectively a digital certificate and can be thought of as an intangible asset. The REC component of 1,000 kWh of solar production is separate from the electricity component as illustrated below. Selling REC’s for monetary value is in addition to and completely separate from utility bill savings.

REC’s are generally sold into either a Compliance or Voluntary market. In a compliance market, REC’s are purchased to comply with Renewable Portfolio Standards (RPS) regulations, which mandate utilities to procure a certain percentage of their electricity supply from renewable sources. In a voluntary market, RECs are purchased by entities that have climate sustainability goals to make the claim of using green energy.

The Western Renewable Energy Generation Information System (WREGIS) is the independent, web-based tracking registry responsible for certifying and minting RECs in California and 13 other western states. In order for RECs to be generated and minted in California, entities must comply with all of WREGIS’s rigorous registration and ongoing reporting requirements.

LCFS Market Explained

The Low Carbon Fuel Standard (LCFS) is an incentive program designed to reduce greenhouse gas (GHG) emissions from the transportation sector using a market-based mechanism that caps the carbon intensity (CI) of transportation fuels. The California Air Resources Board (CARB) established the LCFS in 2009 and is the regulator of the program.

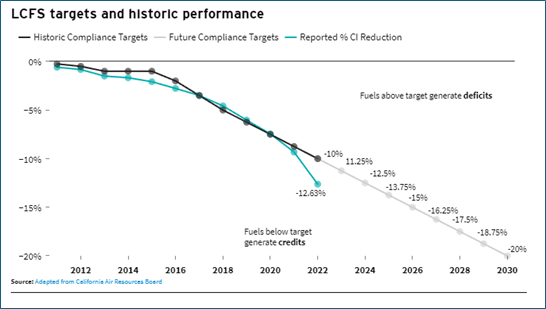

LCFS uses a credit and deficit system. Transportation fuels that have a high CI (above the benchmark) generate deficits, and those that have a low CI (below the benchmark) generate credits. The CI of gasoline and diesel transportation fuel establishes the baseline benchmark for carbon intensity. 1 LCFS credit equals 1 metric ton (MT) of CO2 reduced. The carbon-intensity goal of the LCFS market decreases each year, as shown in the graphic below.

California vehicles that run on clean fuel, such as EV’s, generate LCFS credits for the owners of the charging infrastructure each time a vehicle is charged. The LCFS credits can then be used to offset the business’ CI or sold on the open market. Therefore, the LCFS program incentivizes businesses in California to adopt EVs and create EV charging infrastructure. EV’s currently makeup roughly 25% of all credits in the LCFS program.

- LCFS Credit Buyers: Importers and refiners of high CI fuels (e.g., gasoline and diesel) accrue deficits and need to buy LCFS credits to offset.

- LCFS Credit Seller: Low carbon-intensive fuel producers (e.g., electric, hydrogen, biofuel) and fleet operators.

RECs Generate Additional Value in the LCFS Program

The energy production source mix of the California grid includes natural gas, nuclear, hydro, and renewables resulting in a certain level of carbon intensity. To reduce the CI score of typical grid charging, LCFS credits can be paired with Solar Renewable Energy Credits (RECs) to generate additional value by lowering the CI score. Beginning in 2019, LCFS began recognizing the use of book-and-claim (B&C) accounting of RECs, which allows for the de-coupling of environmental benefits and attributes, enabling them to be transferred separately. Pairing RECs via book-and-claim with LCFS credits demonstrates that the energy used for electric fleet charging is renewable, thereby increasing the amount of LCFS credits.

Buying B&C RECs to claim Zero-CI charging, compared to Grid-CI charging effectively results in ~30% more LCFS credits per MWh of charging. For example, if an LCFS Credit with grid-CI charging is priced at $70, pairing it with a B&C REC to get zero-CI charging would create an additional ~$21 of value (= $70 * 30%). LCFS generators that are looking to capture additional value are not obligated to purchase B&C RECs, but they will do so if it makes financial sense and results in a higher end value. Effectively they will buy B&C RECs if they cost less than 30% of the marginal value they will receive from having zero-CI charging.

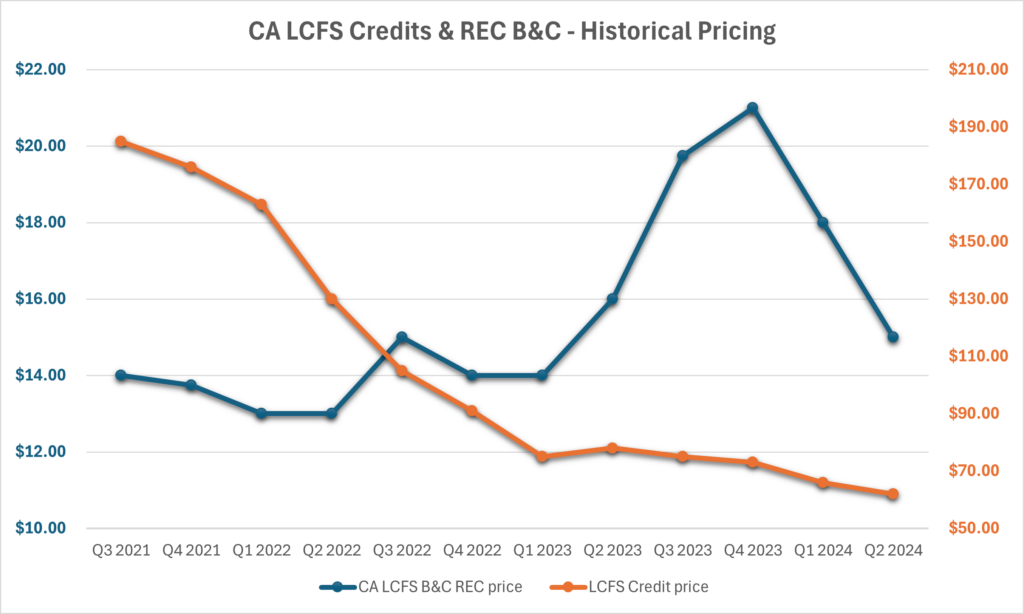

Since 2021, LCFS Credit pricing has ranged between $65 to $200 per credit, while CA B&C RECs have ranged between $14 to $22 per REC as illustrated in the chart below.

What is the Future Expected Price of CA RECs?

The future price of California solar RECs in the LCFS B&C market will fluctuate and cannot be guaranteed. Energy Toolbase’s base case expectation is that REC pricing will stay in the same $14 to $22 range we’ve seen over the last 3 years. For modeling simplicity purposes, our latest version CA LCFS incentive in ETB Developer assumes that prices will average $15/REC for the next 10 years, even though we certainly expect to see continued price volatility. It’s worth noting that 10-year forward price hedges for LCFS B&C RECs have recently traded above $10/REC, which substantiates that REC market demand will likely continue for at least a decade into the future.

CA LCFS B&C REC pricing is directly linked to the supply and demand balance of LCFS Credits and market prices. It is worth noting that LCFS Credits have had consistent oversupply in recent years which has driven LCFS credit prices lower. In Q1 of 2024 CARB data showed the largest ever surplus of credits, driving prices into the low $60’s as shown in the chart above.

CARB is currently in the process of considering major changes to the LCFS program, which would change the supply/demand balance of credits and therefore market prices. Two notable changes CARB is proposing to fix the large oversupply issue are increasing the CI reduction target from 20% to 30% by 2030 and extending the CI reduction target to 90% by 2045.