IMPORTANT MONTHLY UPDATES & ANNOUNCEMENTS

This quarter we’re covering rate decreases for Pacific Gas & Electric (PG&E) and Southern California Edison (SCE) — and also SCE’s 2025-2028 General Rate Case, Indiana rate increases, Illinois’s changing NEM, new team members, and our quarterly numbers.

PG&E and SCE Rate Decreases

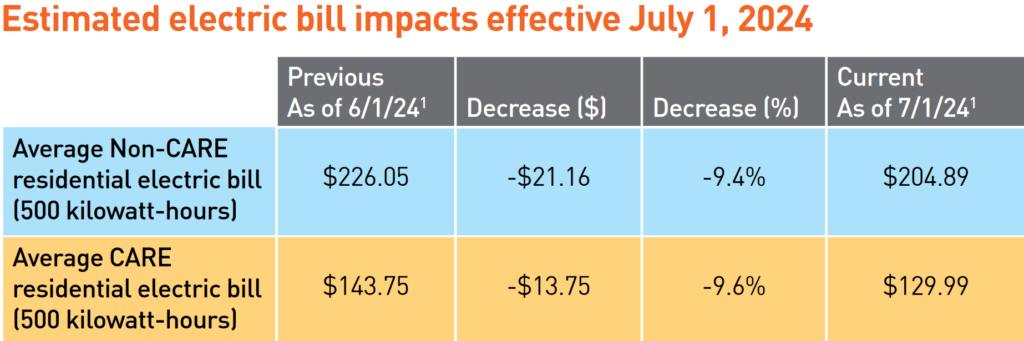

PG&E and SCE both adjusted their revenue requirements this quarter, resulting in overall decreases of 9% and 1.7% to their system average bundled rates, respectively.

PG&E submitted Advice Letter 7307-E to adjust revenue requirements for all customer classifications. A typical residential customer can expect a 9.4% decrease to their bill effective in July:

Small L&P (rate schedules B-1 and B-6), Medium L&P (rate schedule B-10), and B19 customers can expect decreases of 8.4%, 8.7%, and 9.0%, respectively.

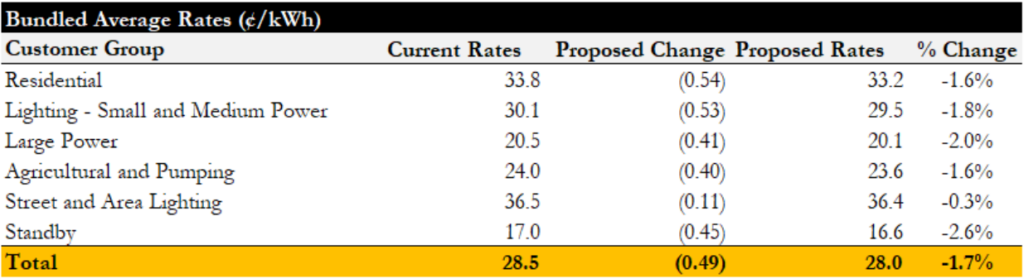

Likewise, SCE submitted Advice Letter 5307-E that went into effect in June with changes to its revenue requirements resulting in minor rate decreases across all customer classes:

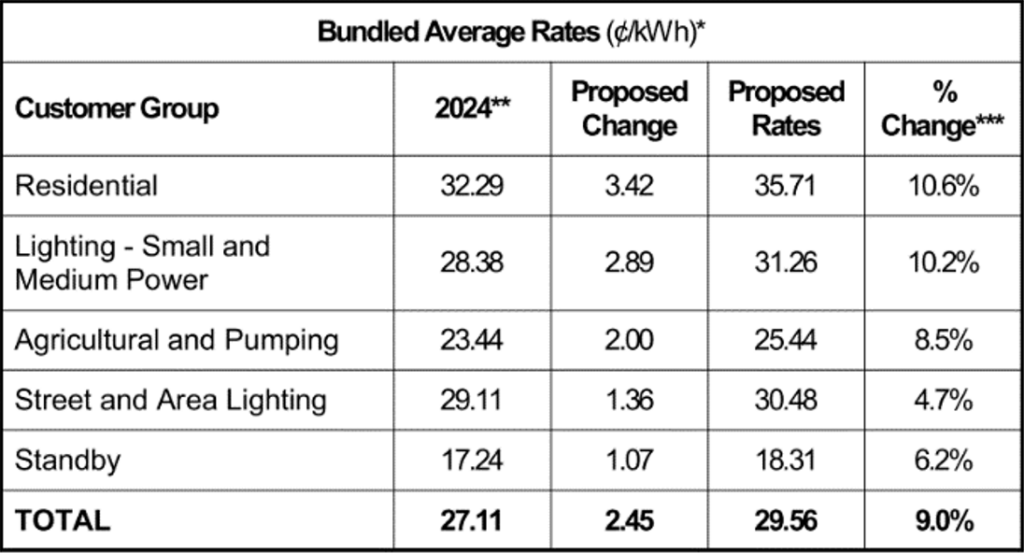

These rate decreases provide some breathing room to California investor-owned utility (IOU) customers who have experienced significant rate inflation over the past decade, as revealed by our definitive whitepaper on electric utility bill inflation in California. However, SCE’s upcoming 2025-2028 General Rate Case is set to continue the trend with a currently proposed revenue increase of $1.895 billion (22.6%) for 2025 that could result in the following increases for customers:

Our utility rates team will continue to monitor these proposed changes and implement them when they go into effect.

Indiana Rate Increases

Indiana IOU customers can expect rate increases in their future as four out of five IOUs in Indiana have filed for rate changes: AES Indiana, Duke Energy, CenterPoint Energy (Vectren South), and Indiana Michigan Power (AEP Indiana). These changes are intended to increase resiliency and reliability and improve the customer experience.

AES Indiana updated their rates for the first time in four years with changes that went into effect mid-May. Residential customers can expect a 7.2% increase to their base rates, while increases vary between 2-10% for small business customers.

Similarly to AES Indiana, Duke Energy filed its first rates change request since 2020 to the Indiana Utility Regulatory Commission. Since that time, Duke Energy has invested $1.6 billion without increasing base rates. The proposed rate changes would roll out as a two-step process to increase overall bill averages by 12% in 2025 and 4% in 2026 for an overall increase of 16%. Each rate class would be impacted differently, with residential customer bills expected to increase by 19%. Duke Energy also seeks to implement voluntary time-of-use (TOU) rates to help customers manage their bills by shifting their consumption to less costly hours.

CenterPoint Energy’s rate increases are scheduled to begin in late 2024 and early 2025 and 2026, with 6.5%, 3.6%, and 7.3% increases, respectively. Some of these increases have to do with CenterPoint Energy’s construction of natural gas plants as part of its plan to shift its generation portfolio away from coal. Like Duke Energy, CenterPoint intends to test TOU rate schedules to help customers combat the increasing costs.

Lastly, Indiana Michigan Power’s proposed rate changes were approved, and the first phase of the changes went into effect at the end of May with the second phase scheduled for January 2025. The overall impact of these changes will be 5.2%.

Looking Ahead - Changing NEM in Illinois

Come January 1, 2025, Illinois’s IOUs will no longer offer full retail net metering. Currently, IOUs like Ameren and Commonwealth Edison offer full retail NEM with exported energy valued at the same rate as the imported retail energy rate. This gives customers with solar systems full value for the energy they export back to the grid. However, under the state’s Climate and Equitable Jobs Act passed in 2021, full retail NEM in the state will end on December 31, 2024. This means that customers who wish to lock in full retail NEM must do so by submitting their interconnection request no later than December 13, 2024, to be grandfathered into the NEM program for the life of their system. Customers who submit interconnection requests after the cutoff date will be placed on the new NEM program.

This new NEM program will no longer offer customers the full retail rate for their exported energy. Instead, NEM credits will apply to the supply portion of the bill rather than the total bill. Additionally, customers on the new NEM program may be eligible for a “Distributed Generation Rebate” valued at $300 per kW of generating capacity upon installation. Overall, the net result of these changes is higher upfront value for your system with a reduced NEM benefit over time.

States across the country like Arizona, Oregon, West Virginia, and Wisconsin are likely to make similar changes to their NEM programs, reducing the overall value that solar customers can receive from NEM. These changes are increasing the value and opportunity for storage system installations in addition to solar. As the value of NEM credits decreases, the value that you can get from storing the energy and using it instead to offset peak charges potentially increases. There has never been a better time to consider storage with your solar installation, and with Energy Toolbase’s Acumen EMS™ and ETB Monitor, you can be certain that you are getting the maximum value from your systems. Schedule a call with us to learn more about our product suite.

Our Growing Team

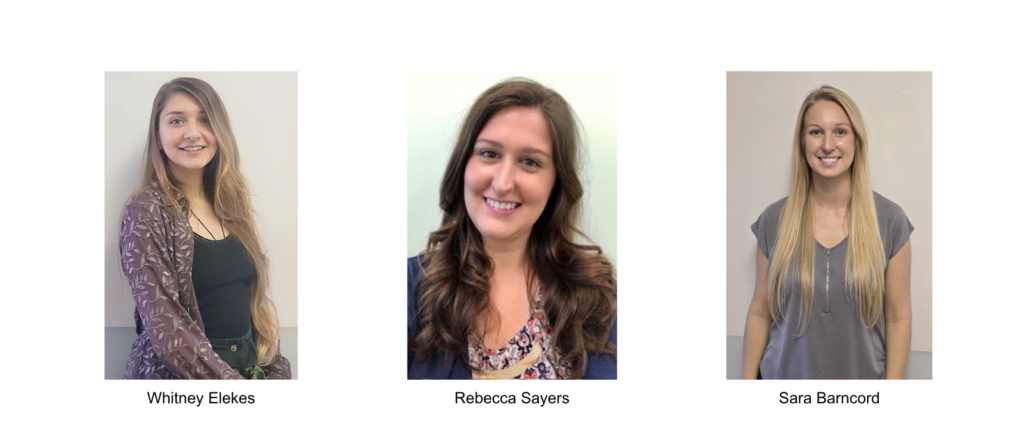

Every year, our utility rates team adds hundreds of new utilities and thousands of rate schedules that need to be maintained for our users. To help update this ever-growing database, we recently added three new members to the team — Whitney Elekes, Rebecca Sayers, and Sara Barncord! They are our newest Global Database Administrators and will make sure our rate schedules contain the most up-to-date information from utilities. Their addition to our close-knit and dedicated team brings us to a total of 10 members. We’re excited to have them join us as we continue to provide our users with the best ETB Developer experience possible.

2nd Quarter Numbers

Our utility rates team enjoys sharing our progress with ETB users because much of it comes from user requests. Every utility and rate we add signifies expanding opportunities for solar and storage, and we think that is pretty neat! We quantify our Q2 successes below:

- New global rates added: 234

- Updated global rates: 1445

- Pre-Proposal Service turnaround time: 2.6 days

- New utilities added: 24

- 14 unique states

- 4 in Texas

- 3 in Wisconsin

- 3 unique countries

- Guatemala

- Canada

- Chile

- 14 unique states