We made a small update to the logic we use to calculate (SGIP) Self Generation Incentive Program energy storage incentives that we want to make users aware of. The SGIP Program Handbook states that the energy capacity of a storage system, which the SGIP incentive is paid based on, is “the nominal voltage multiplied by the amp-hour capacity multiplied by the applicable efficiency (VDC x Amp-Hours x (1 kW/1000W) x Applicable Efficiency).”

In Energy Toolbase we’ve been referencing the ‘Total Energy Capacity’ listed on equipment specifications for SGIP calculations since that data point has been more readily available by (ESS) Energy Storage System vendors. But based on feedback by one of our users, we realize in some cases the ‘Total Energy Capacity’ listed on equipment specifications does not match the energy capacity used by the SGIP Energy Storage Sizing Worksheet calculator.

This can happen when the equipment specifications ‘Total Energy Capacity’ is not 100% usable, so moving forward we feel it’s most accurate to reference the ‘Usable Energy Capacity’ (‘Total Energy Capacity‘ x ‘Max Depth of Discharge’) for SGIP calculations. This will allow us to account for the SGIP rated energy capacity of the ESS calculated by the SGIP Energy Storage Sizing Worksheet calculator in instances where the ‘Total Energy Capacity’ listed on manufacturers specification sheets does not reflect the ‘Usable Energy Capacity’.

In order to get the most accurate SGIP rebate calculations it is important that you calculate the ‘Max Depth of Discharge’ according to the calculation below:

Max Depth of Discharge = SGIP Rated Energy Capacity / Total Energy Capacity

Equipment vendors should be able to provide the SGIP Energy Storage Sizing Worksheet calculation that shows their SGIP Rated Energy Capacity, contact us if you have any issues obtaining this.

To update the SGIP incentives in our database, we have renamed all the legacy SGIP rebates with “legacy” and archived these so they will no longer show up in Step 3. In their place, we have created new SGIP incentives based on the logic described above and made these active, so they’ll default display in Step 3. This will preserve all the existing proposals that have been run using the legacy SGIP rebates. Going forward, SGIP incentives will be calculated on the logic described above.

The Self-Generation Incentive Program (SGIP) provides financial incentives for the installation of new, qualifying technologies including energy storage, wind power, fuel cells, combined heat & power

Calculating SGIP incentives can be tricky, as the incentive amount is dependent on several different system variables. In Energy Toolbase we recently launched our new SGIP global incentives, which were built to be fully dynamic, meaning they should calculate correctly for any scenario. Below is a list of variables that dictate how the SGIP incentive will be calculated.

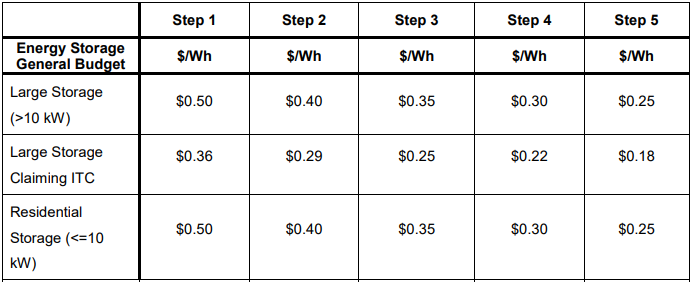

Energy Storage Incentives per Watt-hour (Wh):

If an incentive step becomes fully subscribed in all Program Administrator territories within 10 calendar days, the following step will decrease by $0.10/Wh. Note: the table above has been updated to reflect an accelerated incentive decline of $0.10/Wh in step 2.

Small storage systems or Large storage systems:

There are two categories within the energy storage general budget, which operate independently of each other. “Small residential storage” systems (< 10 kW), and “Large-Scale storage” systems (> 10 kW). Of the total SGIP budget, 80% is allocated to energy storage technologies, with 15% set aside for “small residential storage” projects.

California Supplier – 20% adder:

For projects utilizing equipment manufactured in California, an additional incentive of 20 percent will be added to the project. For a project to qualify for the 20 percent addition, the technology must demonstrate that at least 50% of its capital equipment value is manufactured by an approved California Manufacturer.

With or without an Investment Tax Credit (ITC):

“Large-scale” Energy Storage Systems claiming a federal Investment Tax Credit will receive a reduced SGIP incentive amount, as specified in the table above. The reduction in SGIP incentive when claiming an ITC is equivalent to roughly 28%, depending on the incentive step. To be considered paired with, and charging from on-site renewables, an ESS must charge a minimum of 75% from the on-site renewable generator.

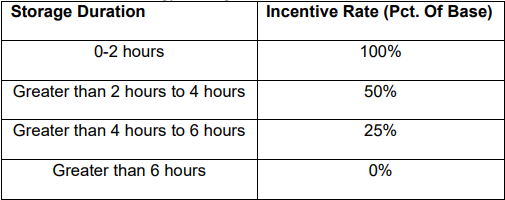

Incentives Decline based on Storage Duration:

SGIP incentives are reduced as the duration of ESS capacity (kWh) increases in relation to the ESS rated power (kW), according to the following schedule:

Performance-Based Incentive (PBI) payments:

For ESS projects 30 kW and larger, 50% of the incentive will be paid upfront and the remaining 50% will be paid as a performance-based incentive (PBI) over a 5-year period. Annual PBI payments will be structured so that under the expected annual operational requirements (130 full dischargers per year), a project would receive the entire stream of PBI payments in five years. To calculate the basis ($/kWh) of the annual PBI payments the following calculation is made:

$/kWh = remaining 50% of incentive / total anticipated kWh discharge

Total anticipated kWh discharge = energy capacity (kWh) * 130 full discharges * 5 yrs

Note: if the ESS cycles more than 130 full discharges per year, the SGIP incentive can be captured in less than 5-years.

Final thoughts:

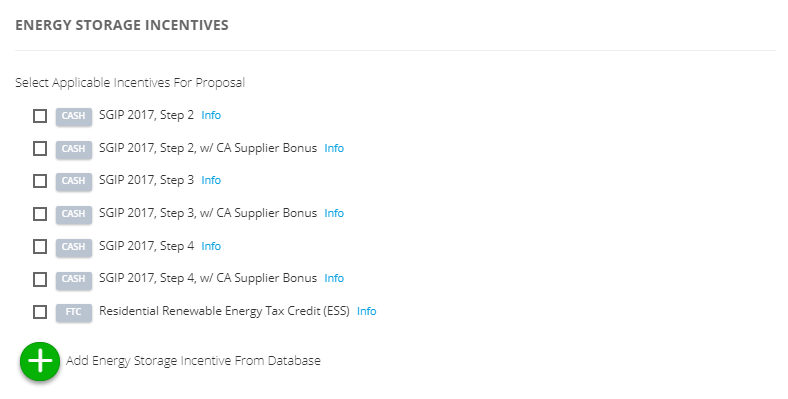

For the time being, we’ve “Activated” the step 2, 3, 4 SGIP incentives, meaning these will be displayed as selectable ESS incentives in “Step 3 – Incentives

You can use this blog as a guide to determine how we dynamically calculate SGIP incentives based on different types of configurations and assumptions. As with all global incentives in our database, users can view our written logic, which dynamically calculates these incentives.