The Self-Generation Incentive Program (SGIP) in California is the longest running and most lucrative incentive program for behind-the-meter energy storage projects in the country. The program received a historic new commitment of funding in 2018 when the California legislature passed Senate Bill 700 (SB 700), which provided the program an additional $800 million in total funding, designed to extend the program for 5 years.

In January of 2020 the California Public Utilities Commission (CPUC) adopted a final decision authorizing the injection of $675 million into SGIP’s energy storage budgets, as directed by SB 700. The decision established the final allocation of incentives by budget category and the framework for the new program rules. This then led to the publishing of the new 2020 SGIP Handbook, which details the specifics of the application process, incentive levels and calculation methodology, and program eligibility rules. The new SGIP program rules as spelled out in the 133-page guidebook are an awful lot to make sense of. In this guide the Energy Toolbase team has decoded the guidebook and distilled down the most pertinent information to help solar and energy storage developers navigate the new rules.

Brief History of the SGIP Program:

Before we dive into the new rules, budget carve outs and qualification criteria, it’s important to give context on how the program got to where it is today. The CPUC has an about the SGIP program page, which provides an in-depth history of the program, explaining that it’s been around almost 20 years and was originally created as a peak-load reduction program in response to the California energy crisis in 2001. In 2006 the program was redesigned to incentive customers who install onsite solar PV systems and eventually included energy storage systems (ESS) into the eligible technologies. The program has evolved significantly since it began, adding and removing eligible technologies, changing incentive levels and the methodology by which they’re calculating and ultimately prioritizing the reduction of greenhouse gas emission (GHG). The GHG requirements were initially put in place in 2009. Today the program states that its primary purpose is to “contribute to GHG emission reductions, demand reductions and reduced customer electricity purchases, resulting in the electric system reliability.”

SGIP Budget Incentive Allocations

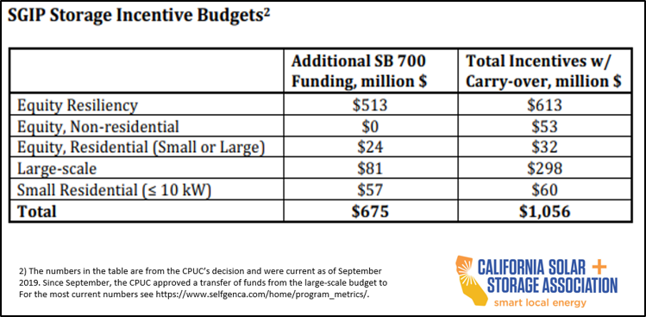

The CPUC’s final decision in January of 2020 allocated $675M of SB 700 funds towards energy storage projects, which represented roughly 80% of the total SB 700 funds. The breakout by category is as follows: Equity Resiliency budget received the lion’s share of the funds, $513M, roughly 76%. Equity, Residential category received $24M, roughly 5%. Large scale storage received $81M, roughly 12%. Small residential, projects under 10 kW in size received $57M, about 8%. The new total incentive amounts by budget category, when combining the new SB700 funds with existing funding can be seen in the table below.

Figure 1: SGIP Storage Incentive Budget breakdown

SGIP Incentive Budget Levels

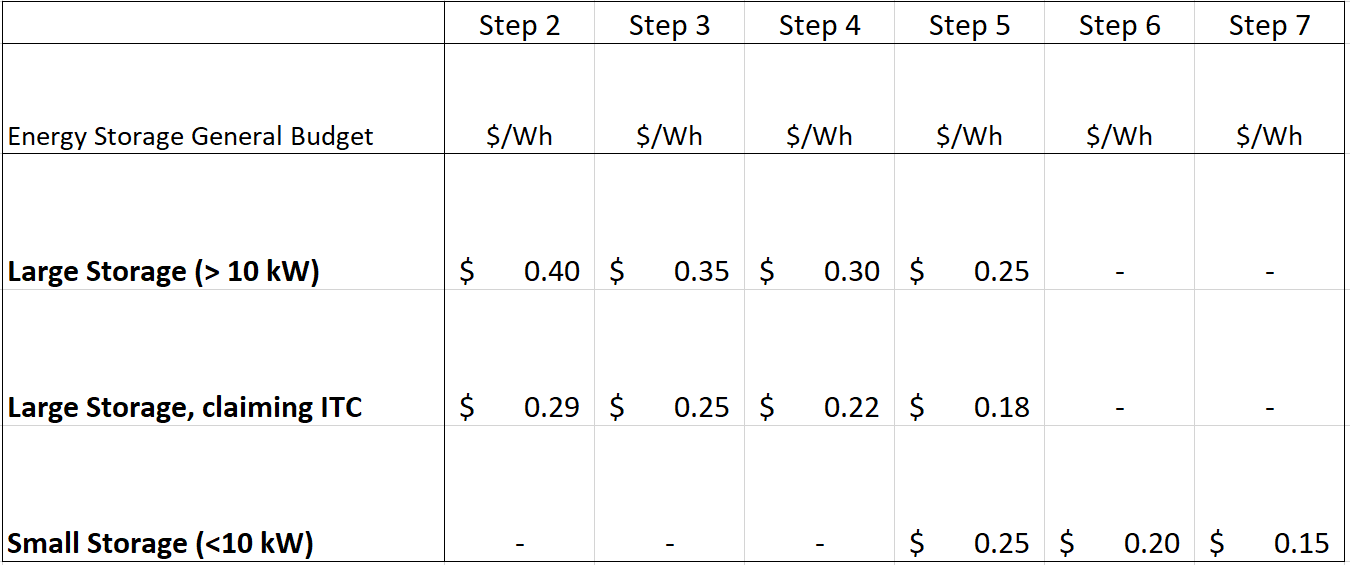

The figure below shows the SGIP incentive levels by step. *Note: steps 2 through 5 are identical to the incentive levels from the 2017 program relaunch. Each step declines by $0.05/Wh, but if a given step becomes fully subscribed within 10 calendar days among all PA territories, the incentive level would decline by $0.10/Wh. A new step 6 and step 7 level was established for the small residential, general market projects. The current incentive steps by category and corresponding rates in each PA territory are updated here: https://www.selfgenca.com/home/program_metrics/.

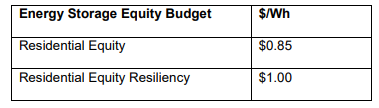

The Equity Budget incentive of $0.85/Wh and Equity Resiliency Budget incentive of $1.00/Wh do not have step down.

Figure 2: SGIP general budget incentives levels by Step

Equity Resiliency Budget

The Equity Resiliency budget is a newly created carve out, which provides incentives for on-site residential and non-residential storage systems for low-income, vulnerable customers in high-risk fire threat districts (HFTD) or those who have been affected by the blackouts across the state, also known as the Public Safety Power Shutoffs (PSPS). PSPS events, also referred to as De-Energization by the CPUC, are preemptive power shutoffs designed to reduce the risk of utility infrastructure starting wildfires. PSPS events are intended to be a preventative measure of last resort if the utility believes there is a significant and imminent risk that weather conditions could lead to increased risk of fire. The Equity Resiliency incentive level is set at $1,000/kWh, which the CPUC has stated was designed to “fully or nearly fully subsidize the installation of a storage system.” The eligibility requirements are as follows:

Eligibility Requirements (residential):

- Are located in Tier 2 or Tier 3 HFTD or were subject to two or more discrete PSPS events to the date of application for SGIP incentives and are one of the following:

- Eligible for the SGIP equity budget

- Medical baseline customer

- A customer that has notified their utility of a serious illness or condition that could become life threatening if electricity is disconnected

- Rely on electric pump wells for water supply

Eligibility Requirements (non-residential):

- “Critical facilities” that are in, or serve at least one low-income area in a Tier 2 or Tier 3 HFTD, or have experienced two or more Public Safety Power Shutoff events

- Police stations, fire stations, emergency response providers, emergency operations centers, 911 call centers, hospitals, skilled nursing facilities, nursing homes, blood banks, health care facilities, dialysis centers, hospice facilities, independent living centers, public and private gas, electric, water wastewater or flood control facilities, jails and prisons, small business grocery stores, and locations that aid during power shutoffs.

Equity Budget

The Equity Budget was designed to provide incentives to low income customers in disadvantaged communities (DAC). The program was originally established in 2016 but never had meaningful uptake given that the incentive level was set at the same amount as the general program. In the new SGIP decision, the CPUC increased the Equity budget’s incentive level to $850/kWh. The eligibility requirements are as follows:

Eligibility requirements (residential):

- Residential projects that are deemed as multi-family, low-income housing or single-family low-income

- Single family eligibility criteria: household income is less than 80% of the area median and home is subject to resale restriction or equity sharing agreement; household income is less than 80% of the area median income and in a Qualified Census Tract, Empowerment Zone or Enterprise community.

- Eligible multi-family housing criteria: a multi-family residential building with at least five rental housing units in which is operated to provide deed-restricted, low-income housing and is located in a disadvantaged community or a building where at least 80% of the households have incomes at or below 60% of the median area income.

- Customer previously qualified for Single-family affordable solar homes (SASH) program.

- To access an area median income tool, click here.

Eligibility Requirements (non-residential)

- A government agency, educational institution, non-profit organization or small business.

- Must be located in a disadvantaged community (DAC)

- DAC defined as any census tract that ranks in the statewide top 25% most affected census tracts (CalEnviroScreen)

Figure 3: Equity and Equity Resiliency incentives per Wh

Commercial customers (general market):

Many of the existing non-residential SGIP program rules carried forward from the 2017 program and handbook, but a few key changes were made:

- Non-residential customer receiving an SGIP incentive will now be required to reduce GHG emissions by at least 5 kg/kWh (see details below in GHG section).

- The minimum cycling requirement for new projects was reduced to 104 cycles/year (it was previously 130 cycles/year).

- All non-residential projects (> 10 kW) are now required to receive half their incentive paid as a performance-based incentive (PBI), paid out annually for up to five years. Previously this only applied to systems greater than 30 kW in size. Systems that do not meet the GHG reduction requirement will reduce the PBI amount (see details below in GHG section).

Most all other of the existing non-residential SGIP program rules from the 2017 program relaunch, which we summarized in a previous blog in 2019 still apply.

Small Residential customers (general market):

Many of the existing residential SGIP program rules carried forward from the 2017 program and handbook, but a few key changes were made:

- All new residential systems must have a single-cycle round trip efficiency of at least 85 percent.

- The new program rules remove the minimum cycling requirement for small residential projects, which was previously 52 cycles/year.

- Residential customers are now required to be on a TOU rate with a peak period starting after 4pm, and with a peak vs. off-peak differential of at least 1.69 to 1. Several existing residential TOU rates qualify, including PG&E’s EV-2, SCE’s TOU-D-PRIME, and SDG&E’s TOU-DR1.

- Residential SGIP developers will be required to submit GHG emissions reduction data twice per year on kWh charged/discharged in every hour, in order to demonstrate their fleet reduces emissions in aggregate.

Resiliency adder

The new 2020 SGIP program will offer an additional $150/kWh (or $0.15/Wh) incentive adder for non-residential customers that do not service low-income or disadvantaged communities. To qualify for the incentive adder ESS projects must demonstrate the storage system can provide resiliency or back-up power and operate in the event of grid outage. This incentive will be additional and added to the step incentive level the customer is eligible for.

Note: the resiliency adder is not expected to go live until the May or June time frame according to the California Solar and Storage Association (CALSSA). Program administrators first need to file advice letters, which are expected to be submitted around April 15.

SGIP incentive limitations

There are a number of incentive limitations for developers to be aware of that are explicitly stated in the SGIP handbook, including:

- Project cost cap. the handbook states that the entire sum of incentives for a project (SGIP and Investment Tax Credit (ITC) combined), cannot exceed the total installed energy storage project cost.

- System overpricing. It’s also important for any developer applying for these projects to be mindful of the cost cap and not overpricing your systems. The guidebook also says when it comes to pricing a system, that developers cannot sell a residential system that receives incentives for more than the price that they would sell a comparable system that wouldn’t qualify for the SGIP incentives.

- The total SGIP incentive amount limit per project is $5 million.

- Developer cap: an individual developer will be limited to 20% of the program incentive funding for a specific general budget category in each incentive step. The developer cap does not apply to Equity Resiliency Budget projects.

Greenhouse Gas (GHG) requirements

As mentioned earlier in this guide, one of the primary stated goals of the SGIP program is to reduce GHG emissions. To that end, in August of 2019 the CPUC added additional program rules which requires energy storage systems receiving SGIP incentives to reduce GHG emissions.

Commercial customers must dispatch their ESS to ensure the system reduces at least 5kg/kWh for each system. If the system does not reduce by at least that level, the customer will lose a portion of their performance-based incentive (PBI) at a rate of $1 per kg ($1,000/ton). The penalty cannot exceed the PBI amount for a given year. Additionally, if a commercial developer’s fleet repeatedly increases GHG, they risk program suspension.

Small residential customers are also required to reduce GHG emissions but will be required to comply at a developer fleet level. If a developer’s fleet is found to increase emissions in aggregate, the developer could face a suspension from the program.

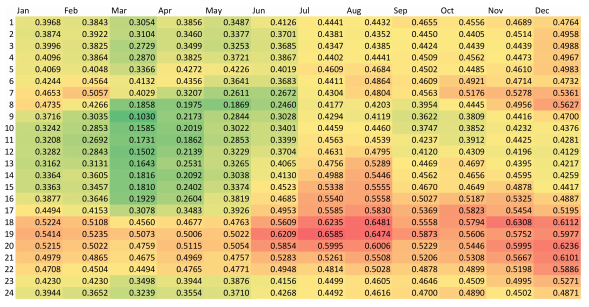

The chart below shows an estimate of the hourly GHG intensity of the grid (kg/kWh). *Note: the high GHG intensity periods generally line up with the 4p – 9pm “on-peak” period, so energy storage systems charging during the day and discharging during the “on-peak” period at night should be in compliance with GHG reductions, assuming they can overcome round trip efficiency loses.

Figure 4: Estimate of hourly GHG intensity of the grid

Updates made in Energy Toolbase

We’ve updated our global incentives in Energy Toolbase to reflect the new rules and incentive levels as summarized above. Our incentives should dynamically calculate the SGIP incentive correctly for all scenarios.

- On 3/11/2020 we published the: “SGIP 2020 – Equity Budget ($850/kWh)” and “SGIP 2020 – Equity Resiliency Budget ($1,000/kWh)” incentives in our database.

- On 3/31/2020 we published the: “SGIP 2020 – Step 3 ($350/kWh)” as well as general market, Steps 4, 5, and 6 incentives. We also archived the legacy SGIP 2017 version incentives.