Key Takeaways

- We extensively studied PG&E’s new Option S rate to determine how utility bill savings for solar + storage projects compared to both the Option R rate and the default option.

- In 80% of the cases we ran, eligible C&I PV+ESS customers are best off opting onto Option S. They would be able to capture the highest bill savings, compared to the other available rate options, all other aspects equal.

- PG&E’s new Option S daily demand charge rate has had limited uptake so far. We expect to see more in the future. There are roughly 300 customers already interconnected who are eligible to opt onto Option S.

- Option S is a good first step in providing ESS a stronger price signal, but we believe there are ways to improve on it. We’re optimistic about more storage-friendly, daily demand charge rates being implemented in the future.

Option S Rate Structure

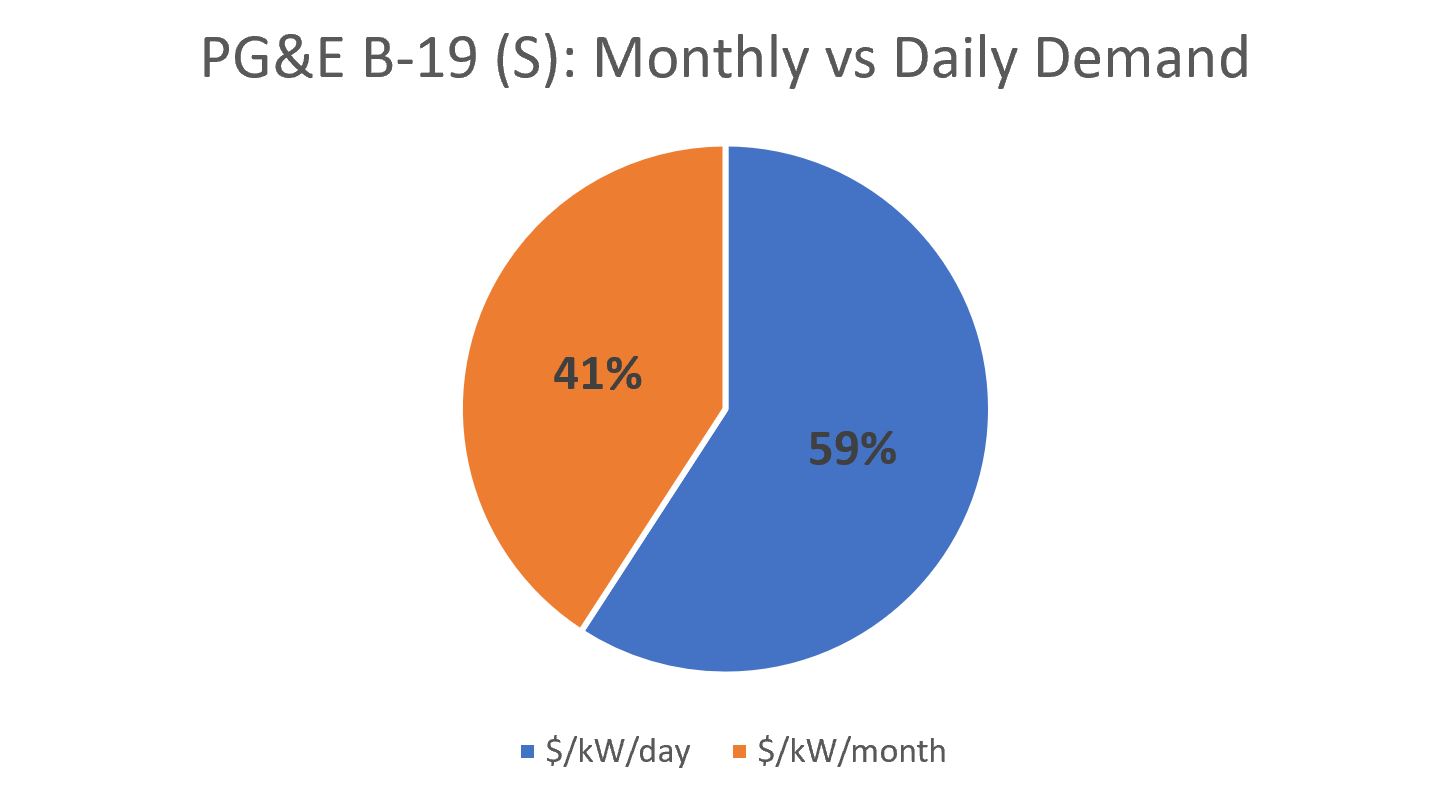

We published a blog last month titled”PG&E’s Option S (for Storage) Daily Demand Charge Rate – Here’s what you should know” that unpacked the design and structure of PG&E’s innovative new rate tariff. The Option S rate has garnered a lot of buzz and inquiries from our userbase, because of the unique $/kW/day daily demand charge component. However, it may be surprising to learn that overall, $/kW/day daily demand charges only make up 59% of total demand charges, while traditional $/kW/month monthly demand charges make up the other 41%.

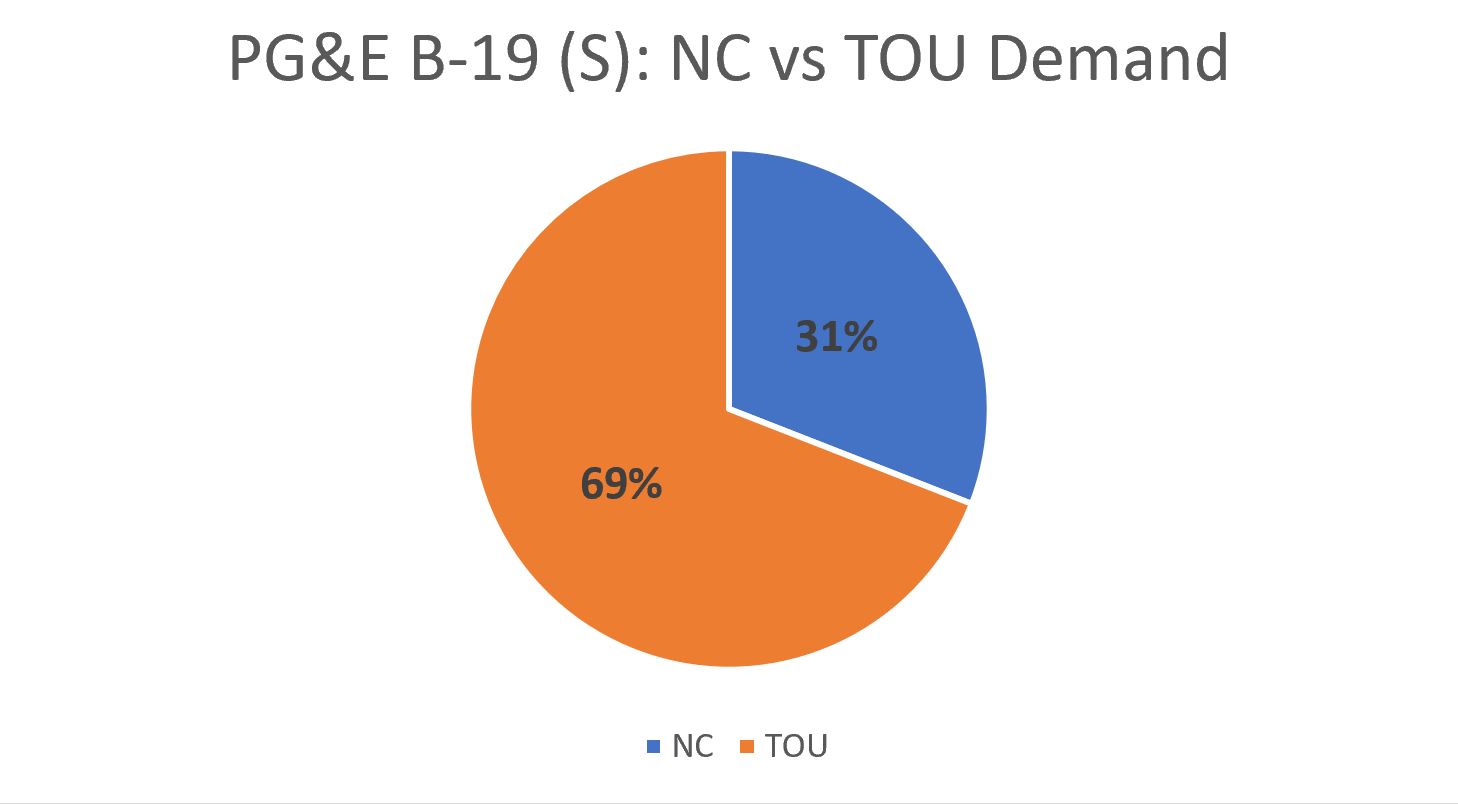

The Option S rate features three types of demand charges: (1) daily demand charges ($/kW/day), which are assessed during “on-peak” (4 pm – 9 pm) and “part-peak” (2 pm – 4 pm and 9 pm – 11 pm) time periods, (2) traditional monthly max ($/kW/month) or non-coincident (NC) demand charges, which are based on the highest measured demand interval in the month, and (3) TOU based demand charges ($/kW/month) assessed for all hours outside of 9 am – 2 pm. Collectively, 69% of Option S demand charges are TOU-based, compared to 31% which are non-coincident.

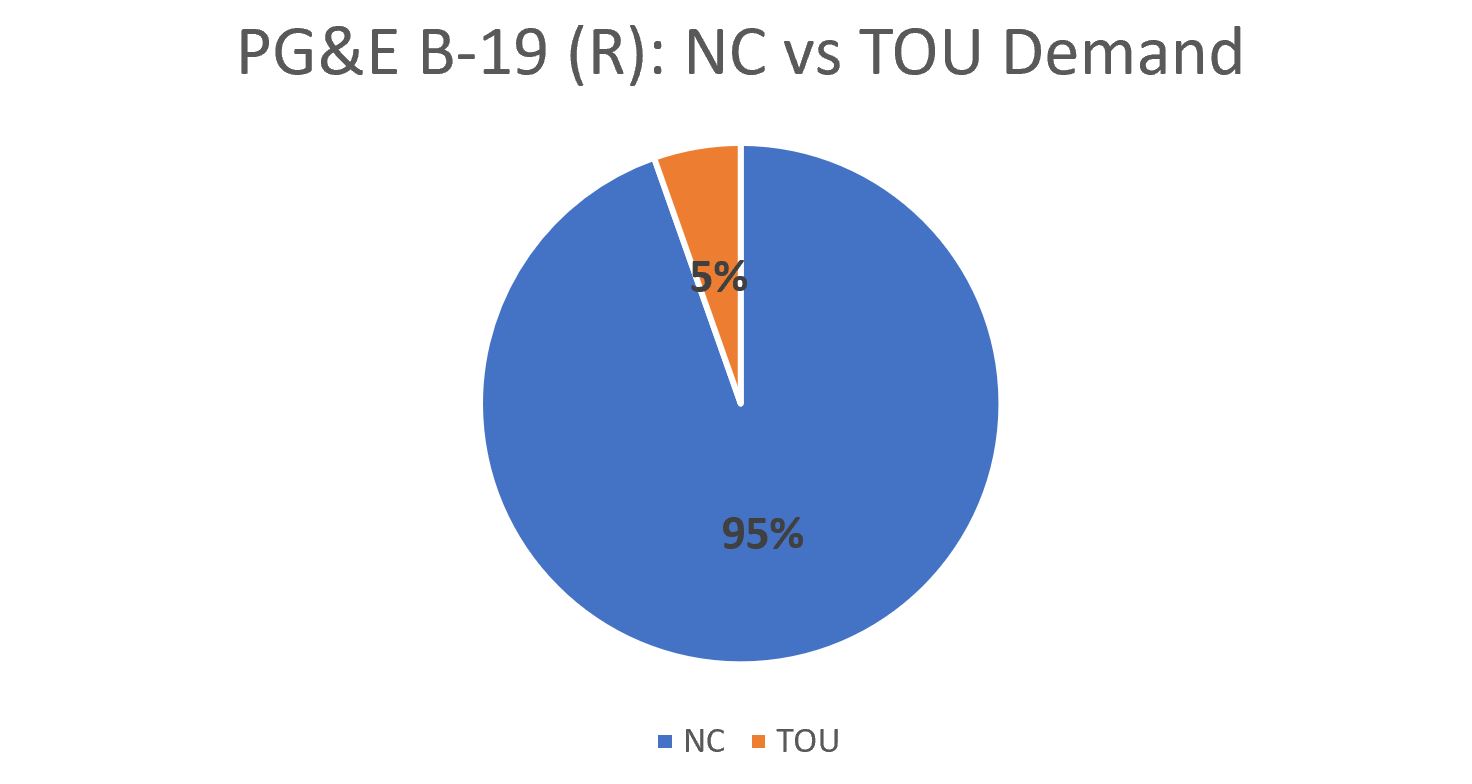

For the solar-friendly Option R rate, this compares to 95% of demand charges being non-coincident, and only 5% of demand charges being TOU-based. As we will see later, this influences how effectively PV+ESS customers can reduce their when comparing Option R vs Option S savings.

How advantageous is “Option S” for PV+ESS economics?

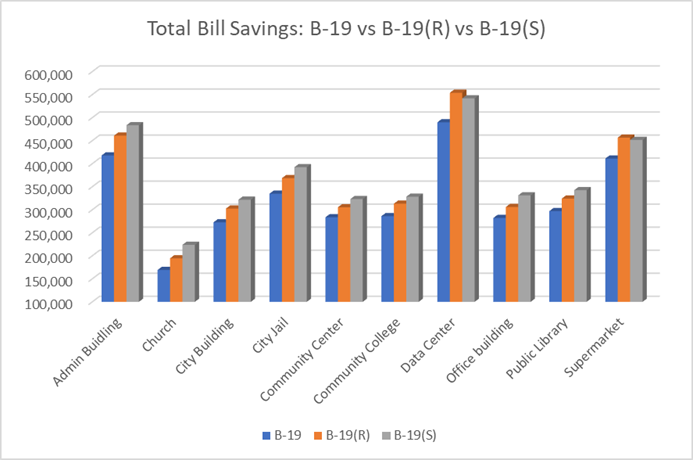

In determining how advantageous the Option S rate is for capturing bill savings for PV+ESS customers, we think about it relative to the other rate tariff options that a customer is eligible for. In our study, we compared total bill savings for a PV+ESS customer on 3 rates: B-19 vs. B-19 (R) vs. B-19 (S).

Given that bill savings can be meaningfully influenced by the customer’s load profile, we ran PV+ESS savings simulations on 10 different load profile types. We utilized real-world load profiles, including an office building, college, supermarket, data center, and a church, that had varying usage patterns and load factors to get a wide sampling of usage types. These were the same load profiles used in the Masterclass analysis we published in February of this year:ETB Masterclass: Optimizing the economics of C&I Solar + Storage projects in California.

We ran three separate analyses for B-19, B-19 (R), and B-19 (S) on each of the 10 different load profiles. In 8 of the 10 cases, Option S yielded the highest total bill savings. In all 10 cases, both Option S and Option R yielded superior savings compared to staying on the default B-19 rate. The average additional savings improvement was not large. On average across all the runs, moving to Option S resulted in 15% more bill savings compared to the default B-19 rate, and 4% higher bill savings compared to Option R. True to its “storage friendly” name, Option S yielded 18% higher bill savings from energy storage on average across all 10 runs, compared to Option R.

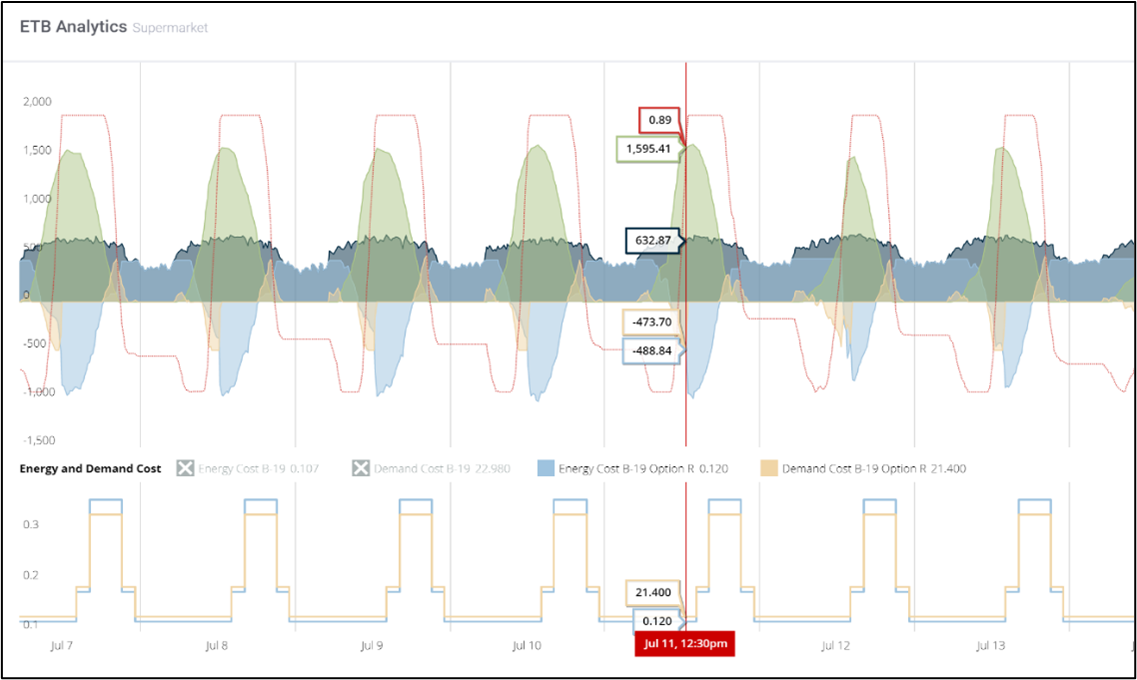

In the 2 runs where the customer was better off staying on Option R, the reason why is a combination of the customer’s load profile pattern and how Option R and Option S recover demand charges differently through either max monthly (aka non-coincident) or TOU based demand charges. For Option R, 95% of demand charges are billed via NC demand. For Option S, this ratio flips with 69% of demand charges getting billed as TOU-based demand charges, and 31% via NC. For customers that peak midday, around the same time that solar PV output is highest, solar is able to more efficiently reduce demand charges on Option R, given that almost all demand is billed NC. The supermarket load profile (shown below) we ran is a good illustration of this.

When the supermarket customer moves to Option S, where only 31% of demand is billed as NC, solar loses out on-demand savings. And while demand savings from ESS go up on Option S, they do not increase enough to make up for the reduced demand savings from PV.

Option S Uptake and Eligibility thus far

In ourpart 1 – Option S blog we highlighted the fact that only a small handful of customers have opted onto Option S already. According to PG&E’s Option S tracker page, which PG&E has confirmed will update monthly, only 12 customers are currently enrolled under Option S, with an additional 10 customers having reserved capacity. We believe this is likely due to the newness of the rate and the market not having software to model and optimize energy storage on the innovative new rate structure. ETB Developer first offered the ability to model daily demand charges as part of our v4 launch in April of this year.

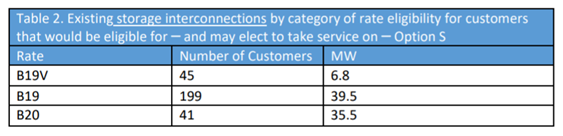

Advice Letter6150-E was filed by PG&E regarding the implementation of the pre-PTO reservation system that is now currently in effect. Within this advice letter, PG&E provided a table of customers with existing storage interconnections eligible to elect service under Option S.

PG&E performed outreach to the 285 already eligible customers to inform them that they would be given advanced access to the reservation system starting July 25th, 2021. Option S capacity for new customers can be reserved prior to PTO issuance beginning on August 24th, 2021. Any customer interested in enrolling or reserving capacity will need to follow the prescribed reservation process.

The Future of Daily Demand Charges

We applaud PG&E for being the first utility in the country to implement storage-friendly, daily demand charge rates. We are strong supporters of rate designs that offer advantageous price signals for energy storage projects. While PG&E’s Option S is a step in the right direction, we have suggestions on how to further improve on the Option S rate. Most notably we think the structure of Option S would benefit from being more streamlined and simplified. Having three separate types of demand charges (NC monthly, 4–9p on-peak, and outside 9a-2p) makes comprehending this rate overly complicated for end-users. Good rate designs and price signals should be easily understandable and send a clear message to the customer on what type of usage behavior the utility wants. Furthermore, having a 60%/40% split between $/kW/day and $/kW/month demand charges is confusing. Given that this is a “daily-demand charge” rate, it would be ideal to put as much demand charge cost recovery into the $/kW/day daily demand charge as possible. This would provide the most unambiguous signal to the energy storage system on when to dispatch.

We are optimistic that Southern California Edison (SCE) and San Diego Gas & Electric (SDG&E) will follow suit and implement “storage-friendly” daily demand charge rate options in their upcoming general rate cases (GRC); demand charge studies and workshops are already being conducted. We commend the efforts of the Solar Energy Industries Association (SEIA) who originally proposed and lobbied for Option S and got it approved by the CPUC. Having studied C&I rates all over the country, oftentimes the energy storage savings opportunity that a tariff offers is not commensurate with the value that storage can provide. Longer-term, it would be great to see other states and utilities outside of California follow suit and implement daily demand charge rates.

Key Links