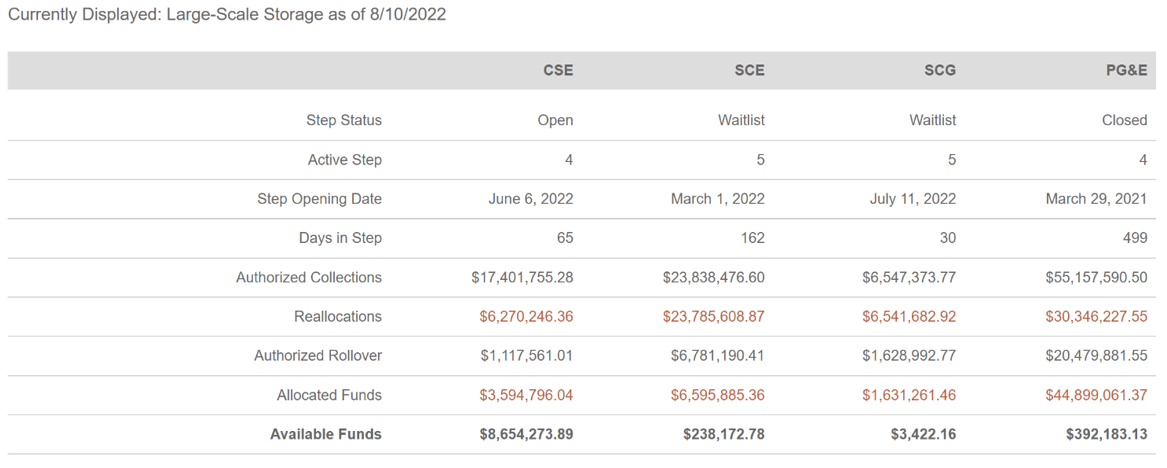

The Self-Generation Incentive Program (SGIP) for large-scale storage projects is quickly coming to an end. As we previously reported in March of this year, Southern California Edison (SCE) was the first of the investor-owned utility (IOU) territories to exhaust its large-scale storage SGIP budget completely. At that time, Pacific Gas & Electric (PG&E) had roughly $16 million available in its final large-scale storage budget step, and San Diego Gas & Electric (SDG&E) had a total of about $15 million. In March, we predicted that the remaining funds could get reserved as quickly as the end of 2022. Fast forward to August, and PG&E has already exhausted its remaining available funds in the large-scale storage category, while SDG&E has only $8.7 million left to be reserved.

Summary:

- PG&E territory. Reservation requests exceeded available funds on 8/3/2022, which triggered a lottery. Once the lottery has been finalized, the status will change to “Waitlist”.

- SDG&E territory. As of 8/10/2022, there is $8.7 million in large-scale storage available funds.

- SCE territory. In March of 2022, SCE was the first of the IOUs to deplete their large-scale storage SGIP budget.

- SoCalGas territory. The remaining funds were exhausted around June or July of 2022.

We expect reservation requests to accelerate in the SDG&E territory now that it’s the last utility with large-scale storage funds remaining. Based on the rate of reservations we’ve seen in the other IOUs, we think there’s a strong chance that SDG&E’s remaining budget will be exhausted by yearend. For battery project developers and host customers contemplating adding an energy storage system (ESS) in the SDG&E territory, we strongly encourage you to move quickly to complete the steps required to reserve funds. Instructions on how to apply for a reservation, including the SGIP Handbook and Reservation Request Form (RRF), can be found here.

What does this mean for California’s C&I energy storage market?

Lacking SGIP funds is an obvious headwind for the California energy storage market. However, the economics of energy storage remains strong in California, and we have sound reasons to be optimistic about its continued growth. Most notably, the recently announced Inflation Reduction Act bill that passed the United States Senate and is expected to get signed into law includes a new standalone energy storage Investment Tax Credit (ITC) at 30%. Our recent blog,Standalone Energy Storage – Investment Tax Credit (ITC) in the Inflation Reduction Act of 2022: What You Need to Know, summarizes the provisions that impact energy storage projects. The new 2022 Building Energy Efficiency Standards (effective January 1, 2023) serves as another tailwind for the market, requiring all newly constructed commercial buildings to include solar and storage installation. The California Energy Commission estimates that this order alone will spur an additional 400 MWh of storage deployments annually. We summarized those rules in a recent blog,California’s New Building Energy Efficiency Standards, Mandating Solar + Storage, are set to go into effect on January 1, 2023. Lastly, another upcoming tailwind for California’s ESS market is expected to come from the Final Decision on California’s successor net metering tariff “NEM-3″, which likely entails significantly reduced solar export rates, creating a strong price signal for adding storage to solar projects. The California Public Utilities Commission is expected to issue its Alternate Proposed Decision later this month, with implementation slated for some time around the end of the year. So, even with the landmark SGIP incentive program coming to an end, several gusty tailwinds will continue moving California’s storage market on an upward trajectory.

Learn more about the key policy issues in the California solar + energy storage market and access reports on how they affect the economics of projectshere